Back in April 2017, HM Government started rollout of Tax-Free Childcare (TFC) across the UK; the scheme was fully rolled out by the end of 2017. TFC is a savings account which parents can use to pay for childcare. For every £8 parents pay in, HM Government adds another £2.

Parents can save up to £2,000 per year (£4,000 where children are registered as disabled). To qualify for TFC, both parents have to be in paid employment, each working a minimum of 16 hours per week at the National Minimum/Living Wage (approx. £130 per week).

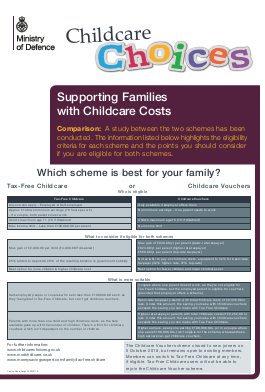

Sign-up to TFC across the Service community has been relatively low. This may be because parents are still making use of the Childcare Voucher scheme (CVS), which closed to new entrants in October 2018, or because parents are unsure whether they are eligible for TFC. Parents can check eligibility for TFC by visiting www.childcarechoices.gov.uk.

A step-by-step guide can be found at https://www.childcarechoices.gov.uk/how-to-use-tax-free-childcare/. Parents leaving the CVS to join TFC will not be able to re-join the CVS. A poster comparing the two schemes is at the link below.

Eligible parents posted overseas can access TFC as long as they use MOD approved childcare providers. This includes childcare offered by MOD schools and nurseries, and Ofsted regulated and inspected childminders. Parents in non-MOD school areas can access TFC only when the provider is regulated, registered and inspected by the relevant host nation and both the parent and provider have access to a UK bank account.

The TFC DIN was updated in May 2020 and can be accessed via defnet – 2020DIN01-054 (internal users only).

Please click on the poster below for more details: